LoanCirrus Lending Platform

Automation doesn’t have to be impersonal. Smart automation gives you more time to provide service that’s more personal, where it matters most. LoanCirrus helps you manage and run each aspect of your lending business. Full spectrum automation — customer onboarding & compliance, application processing, loan servicing, collecting repayments and providing analyses and reporting for betterment.

In the end and at the beginning, it’s all about the borrower. We never forget that and we know you don’t either.

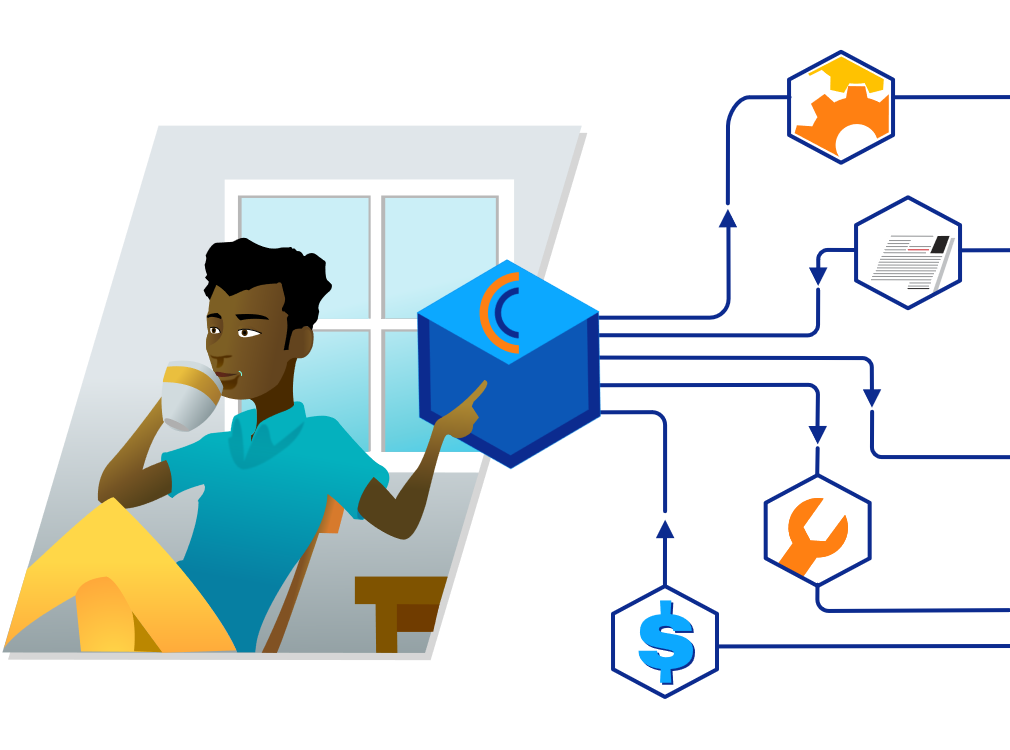

Digital is a Journey

Automation is the roadway

- Automate core origination and KYC processes.

- Automate customer communications.

- Automate all or some of decisioning and disbursements.

- Easily integrate 3rd party Apps through APIs.

- Automate payments and collections.

Your Lending Future Begins Now

A conversation about the first step is all that we need to get going.

Build Lending Products

Create unique lending products from multiple interest calculation methods. Close more loans.

Rapid Deployment

An experienced team takes you from ideation to implementation.

Operating Efficiently

This was always the goal. Some lost their way. LoanCirrus gets you back on track.

Smart Documents

Automate documents natively or integrate with others.

Customer Experience

Wow. Finally, a 'back-office' that supports the customer journey.

Verify Borrower Identity

Integrate with external agencies for KYC, AML and other compliance needs.

Online Onboarding

Onboard customers online or in office. Determine your KYC requirements. Remain compliant.

Broaden Reach

Connect to 3rd party sources for more services