Autonomous Lending

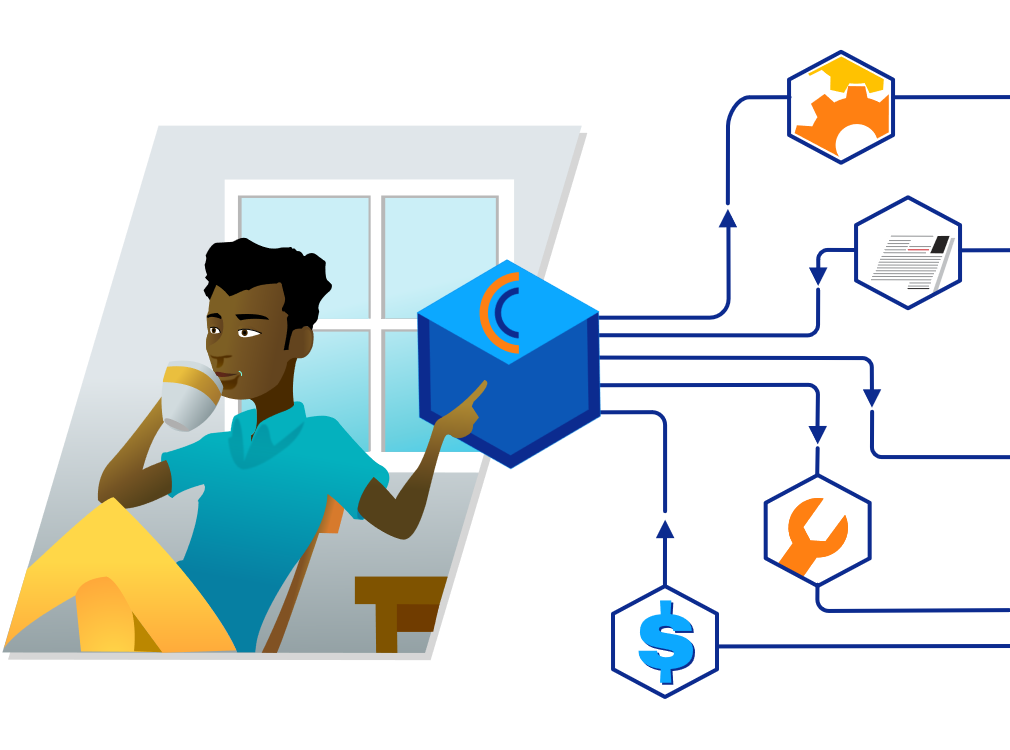

The wide acceptance and understanding of autonomous driving reveals a simple truth: we never really wanted to drive a car, we just wanted to get to some place. So, we are ok with cars driving us around and we can see that the time we currently spend worrying about navigating a car to a location can be better used. Similarly, Autonomous Lending is about automating the lending process so there is more time for building your business.

Change has come. Lending doesn’t require expensive and complicated systems with multi-year lock-ins and costly maintenance and support obligations.

The Building blocks of Autonomous Lending

Automated Borrower Verification

Identify & verify. Comply with KYC obligations. Reduce human error. Embrace a process that is effective and accurate.

Friction-free Onboarding

Empower borrowers to self-serve. Manage their customer journey. It's more than having a website. It's about having REACH.

Smart Decisioning

Smart, flexible, profitable. Access & blend external & internal credit scores. Decisioning just got smarter.

Secure Contract Servicing

Integrate e-signature and automate documents processing

Automate Borrower Communications

Personalized communications at scale across multiple digital touchpoints: email, SMS. Voice, etc.

Less Paperwork, More Time

SMS. Voice, etc. Less Paperwork, More Time Automate and increase reliability, erase human-error, reduce costs, and expedite closing.

Explore our Solutions

Reach

Reach

LoanCirrus

LoanCirrus

PayCirrus

PayCirrus

BankCirrus

BankCirrus

What is Origination Intelligence?

Are you still dealing with branch visits, human errors, massive IT departments & budgets, poring over spreadsheets and managing your business with different technology solutions that can’t be integrated?

Experience freedom so you can focus on other areas of your business like growing your market share. Let machines handle the repetitive tasks that bog you down. Automate manual tasks to ensure they are handled speedily and accurately. Free up staff to focus on customers.

Autonomous Lending means:

Highly automated borrower identification & onboarding.

Highly automated product-customer fit.

Highly automated underwriting & risk management.

Highly automated servicing of contracts.

LoanCirrus is robust, yet flexible to be configured for your specific business operations. Smart lenders cut more costs and reduce closing times when they ensure their internal processes are friction-free, and their customer experience is seamless.